Online shopping has become a major trend, and for a good reason. Who doesn't love the convenience of shopping from the comfort of your own home? And with flexible payment options, it's even easier to get the things you want without breaking the bank.

With BNPL, you can indulge in your purchases right away while paying for them over a period of time. This option offers a flexible and cost-effective shopping experience, giving you the freedom to buy the things you desire without any financial worries.

In a nutshell: What is BNPL?

In today's hustle and bustle, online shopping has become a hot favorite, especially among the younger generations - Gen Z and Millennials. Thanks to the advent of 'buy now pay later' options, online shopping has become more convenient than ever!

This payment option allows you to buy your desired items and pay for them later, in installments, with the first installment at checkout. And guess what? This type of online shopping has become all the rage because it offers the freedom to get anything you want without breaking the bank.

But hold up, before you go on a shopping spree, there are a few things you need to keep in mind. Here are 10 essential tips to make the most of these payment options and avoid any financial mishaps.

The buy now, pay later (BNPL) trend is skyrocketing! Industry experts predict a staggering over 450 billion USD increase in BNPL transactions between 2021 and 2026. This isn't the first time we've seen such a surge - between 2019 and 2021, BNPL already skyrocketed by almost 400%. Now, it's safe to say that BNPL is here to stay.

#1: Plan your budget

First things first, create a budget and stick to it. Yes, you may not have to pay upfront, but you'll eventually have to pay the full amount, so don't go overboard.

#2 - Pay attention to the details

Read the terms and conditions carefully before using any payment option. We don't want any fines for late payments ruining our shopping high, so it's best to know what you're signing up for before proceeding. Keep the small print off guard!

#3 - Choose a reputable provider

Numerous providers are out there, but they need to be on the same page. It's important to conduct thorough research and settle for a credible provider with a solid reputation and open about their charges and policies. Don't be fooled by flashy marketing gimmicks or shady providers. Be wise and choose a provider that you can trust. After all, it's always better to be safe than sorry.

#4 - Save BNPL for big-ticket purchases

While it's a lifesaver for big-ticket items, like a new couch or laptop, it's not the smartest move to use for your weekly grocery haul or fill up your gas tank. Reserve BNPL for those larger expenses you can manage over a longer period. Remember, moderation is key.

#5 - Set reminders on time to pay bills

To dodge those pesky late payment fees and avoid any penalties, it's crucial to pay your bills on time. So, why not set some alerts or reminders on your calendar? That way, you can stay on top of your payment deadlines and dodge any potential mishaps.

#6 - Monitor your payments

Staying on top of your payments and outstanding balances while utilizing BNPL services is crucial. With multiple purchases, getting lost in the sea of expenses is easy. Therefore, staying organized and maintaining a record of your transactions is essential to avoid surprises. No need to be caught off guard with unexpected bills, am I right?

#7 - Avoid reaching the limit on your credit card!

It's necessary to keep in mind that maxing out your credit card with BNPL is similar to any other type of credit. It's best to stay away from reaching the limit to avoid damaging your credit score and making it more challenging to get approved for other credit options down the line. Choose your plan wisely, and remember not to bite off more than you can chew!

#8 - BNPL: a powerful tool; use it wisely.

A great financial tool, BNPL can help you manage your expenses efficiently. Hold your horses though; it's vital that you use it responsibly. Be careful not to use BNPL for unneeded or unaffordable purchases, and make sure you pay on time to avoid any inconveniences.

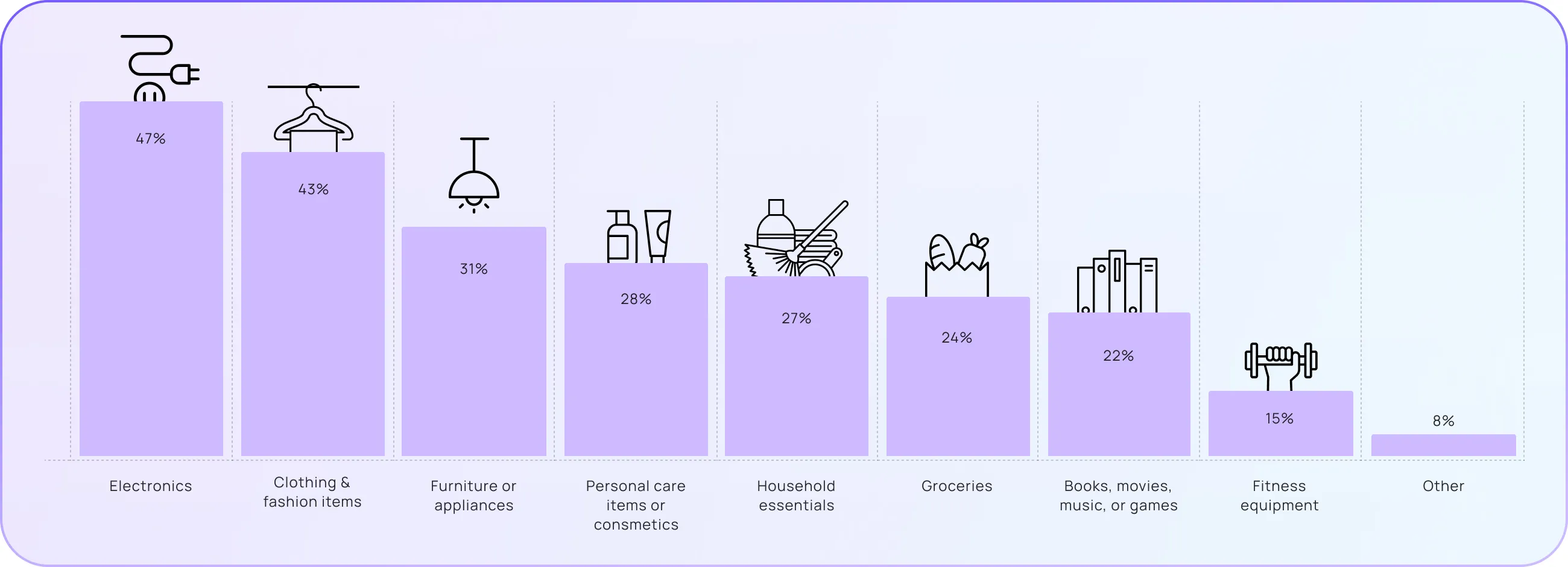

As more and more people gain access to buy now, pay later services, it's no surprise that they're using it for various purchases. Contrary to popular belief, these services are for more than just splurging on non-essentials. In fact, they're proving to be a lifesaver for consumers who need help covering basic expenses like household essentials, for example, electronics.

#9 - Avoid using BNPL to manage debt

It may seem like an easy way out, but it will only add fuel to the fire in the long term. Instead, prioritize paying off your existing debt as soon as possible and refrain from taking on any new debt. Remember, slowly and steadily, you’ll win the race when it comes to your financial well-being.

#10 - Always plan ahead when using BNPL

A clear-cut strategy for paying off your purchases before making them will help you avoid financial mishaps. Setting a roadmap will help you steer clear of a circumstance where you may struggle to pay your dues on time. So, plan ahead and stay financially sound!

Start your shopping journey, but wisely!

To sum it up, BNPL is a nifty trick to handle your finances and make costly purchases more pocket-friendly.

However, as with any financial aid, it's crucial to use it sensibly and prudently. By implementing these 10 quick pointers, you can effortlessly keep track of your budget and dodge any monetary snags while utilizing BNPL payments. So, get ready to shop but don't forget to stay smart about it.

Download the cashew app for IOS and Android, and start your digitalized shopping journey with cashew.